Two Jump Diffusion Processes

Two Jump Diffusion Processes

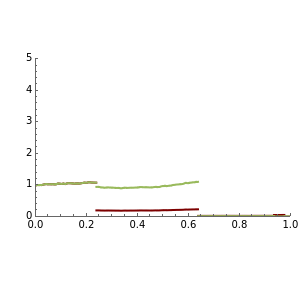

Jump diffusion processes are the simplest generalizations of the classical Black–Scholes model of stock price movements that include discontinuous jumps in price. This Demonstration compares the two most popular diffusion processes: the Merton model and the Kou model. One path from each model is shown. The models share the same continuous component and initial value but differ in their jump distributions, hence their trajectories coincide until the first jump of either process occurs. Kou's model, having 6 independent parameters versus Merton's model's five, is more flexible, hence we expressed the parameter's of Merton's models in terms of those of Kou's one. Thus the two paths shown have the same drift, diffusion as well as mean jump size and the standard deviation of jump sizes.