The Price of a Call Option on Electrical Power

The Price of a Call Option on Electrical Power

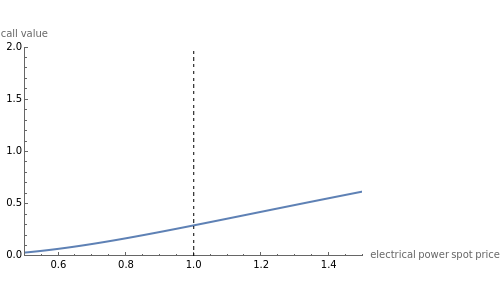

We demonstrate the formula for the value of a call option on electrical power obtained by Tino Kluge, which is analogous to the classical Black–Scholes formula. The model of spot price movements is described under a risk-neutral measure by =exp(f(t)+), where is a mean-reverting process satisfying , and is Brownian motion. The deterministic seasonality function is supposed to capture all relevant components of the market that vary predictably with time. Here we use an oversimplified model, , where the trigonometric component reflects weekly periodicity (time is measured in years, with 365 days per year and 7 days per week).

S

t

X

t

X

d=-αdt+σd

X

t

X

t

W

t

W

t

f(t)

f(t)=a+bcost

2π365

7

t

The expiry time of the option is one year, although options with much longer expiry times are sold in certain markets. The strike of the call option is fixed at one and that of the spot price is assumed to lie between 0.5 and 1.5. For certain settings of the parameters you can get a better graph by changing the range of call values shown on the vertical axis by moving the "vertical range" slider.