Options: Time Value

Options: Time Value

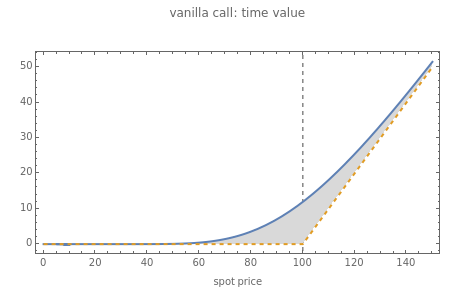

This Demonstration illustrates the concept of "time value" for European-style put and call options of both "vanilla" and "binary" type. The time value of an option is the difference between its current price and the payoff that would be obtained if it could be exercised at the current spot price. Regular vanilla options always have positive time value, whereas binary options can have either positive or negative time value. The magnitude of the time value is largest for "at-the-money" options (when the spot price equals the strike price). For simplicity, we assume zero interest rates and consider a fixed strike price of 100.