NPV and its Contributions

NPV and its Contributions

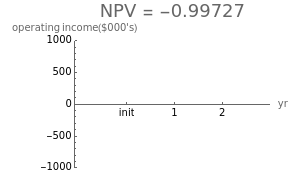

Net Present Value (NPV), the sum of discounted cash flows, is an approach used to judge whether to undertake a new product-commercialization project and/or a way to compare the relative value of proposed projects competing for the same resources. The higher the NPV, the better return the project has for the business. This Demonstration allows for the quick computation and visualization of NPV over a three-year period.