Maximizing a Bermudan Put with a Single Early-Exercise Temporal Point

Maximizing a Bermudan Put with a Single Early-Exercise Temporal Point

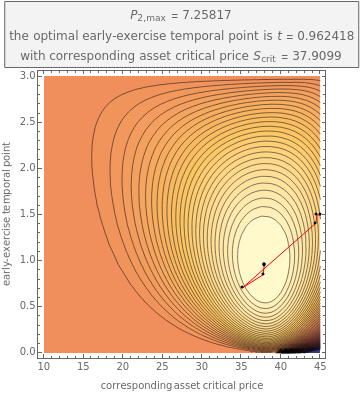

This Demonstration locates the optimal early-exercise temporal point and the corresponding asset critical price that maximize the value of a Bermudan put with a single early-exercise temporal point. Bermudan options can be exercised only on predetermined temporal points and are considered a combination of American and European options. American options are exercisable anytime up to the date of expiration, while European options are exercisable only at the date of expiration. Bermudan options are exercisable at the date of expiration and on certain specified time points that occur between the option purchase date and the date of expiration.

Use the controls to select the option parameters and contours, and then monitor the steps to optimization; the default coordinates for the starting point are the strike price and the midlife of the option. You can change the default starting point in the code and monitor how optimization is reached.