Geske-Johnson Method

Geske-Johnson Method

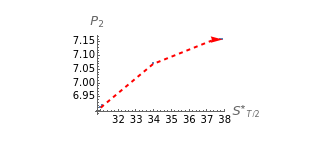

This Demonstration locates the asset critical prices, denoted , that optimize the payoff function of uniformly time-discretized Bermudan puts with one and with two ) possible early exercise temporal points (lower and upper graph, respectively). While European options can be exercised only at the date of expiration, Bermudan options extend the notion of exercise to a finite number of time points during their life. American options, which can be exercised at any time up to maturity, can be approximated by considering Bermudan options, where the number of early exercise points becomes considerably dense; Geske and Johnson [1] apply Richardson extrapolation to accelerate the convergence to an American option.

*

S

()

P

2

(

P

3