Binomial Black-Scholes with Richardson Extrapolation (BBSR) Method

Binomial Black-Scholes with Richardson Extrapolation (BBSR) Method

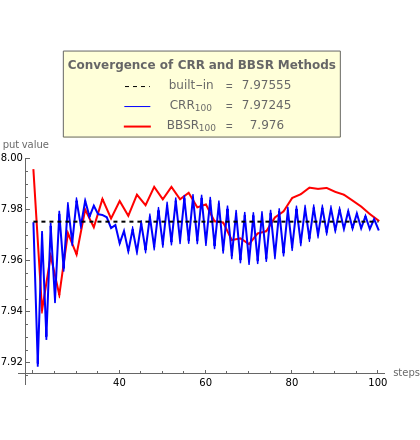

This Demonstration shows the convergence of the binomial Black–Scholes with Richardson extrapolation (BBSR) method [2] compared to the standard binomial Cox-Ross-Rubinstein (CRR) method [1], depending on the American put option's maturity time discretization. Use the controls to set the option's parameters and time discretization (up to 100 uniform steps); the table shows the American put value approximations at the selected number of time steps. The horizontal black dashed line represents the option's value according to Mathematica's built-in function FinancialDerivative with a grid size .

2000×2000