American Call and Put Option

American Call and Put Option

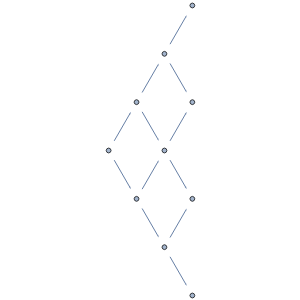

This illustrates the Cox–Ross–Rubenstein binomial tree method of computing the value of a standard American call and put option. Values at the tree nodes show the stock price. Red denotes nodes where it is optimal to exercise the option. A more accurate option value (using 100 time steps) is shown in the bottom left corner.

Point the mouse at a graph node to see the option value corresponding to this particular moment in time and the stock price shown on the binomial tree. Point the mouse at the root of the tree to see the option value at the initial time.