Merton's Jump Diffusion Model

Merton's Jump Diffusion Model

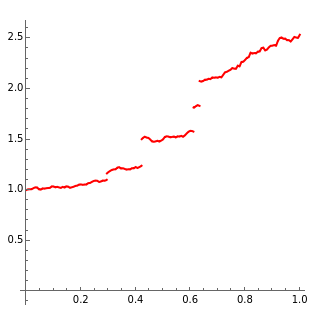

This Demonstration displays one path of Merton's "jump diffusion" stochastic process. This process extends the notion of the standard Black–Scholes model by allowing discrete jumps in addition to a Brownian process motion as the source of randomness. The jumps occur at random times. The interarrival times of the jumps follow an exponential distribution, while the size of the jumps has a normal distribution. Setting the mean size of jumps and the standard deviation to zero (the default) yields a path of a Black–Scholes process (exponential Wiener process).

Details

Details

The popular Black–Scholes model of the movement of stocks is known to be unsatisfactory for several reasons. A number of other models have been proposed that more accurately correspond to the observed behavior of stocks. One of the simplest such models is the Merton jump-diffusion model. The model adds to the Wiener process (which has continuous paths) a finite number of discrete jumps, whose times follow the Poisson distribution. In Merton's model, the size of the jumps is normally distributed. The jump intensity, jump mean size, and jump standard deviation affect the "jumping" aspects of the motion. The initial value, drift, volatility, and the number of steps used in simulating the continuous Wiener process. The "number of jumps" parameter essentially controls the duration of the process.

External Links

External Links

Permanent Citation

Permanent Citation

Andrzej Kozlowski

"Merton's Jump Diffusion Model"

http://demonstrations.wolfram.com/MertonsJumpDiffusionModel/

Wolfram Demonstrations Project

Published: March 7, 2011