A Mean-Reverting Jump Diffusion Process

A Mean-Reverting Jump Diffusion Process

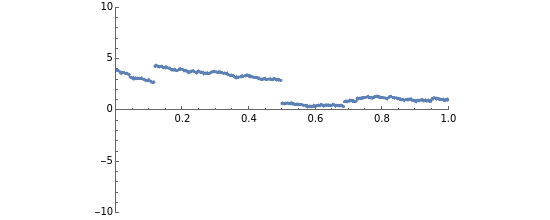

This Demonstration shows a path of a mean-reverting jump diffusion process (with mean 0) with normally distributed jumps. Such processes can be used for modelling the logarithm of the price of a commodity such as gas, oil, etc. that is subject to irregular disruptions but tends to revert to the mean (the production cost of the commodity).

Details

Details

The stochastic process modelled here is described by the stochastic PDE:

d=-αdt+σd+d

Z

t

Z

t

W

t

J

t

N

t

where is the standard Wiener process, is normally distributed, and is a Poisson process. The coefficient is the volatility of the continuous random component of the process and the coefficient is the rate of mean reversion. In order to obtain rapid return to the mean after "spikes" that one observes in electric energy markets, has to be set to a high value.

W

t

J

t

N

t

σ

α

α

References

References

[1] T. Kluge, "Pricing Swing Options and other Electricity Derivatives"[doctoral thesis], Oxford, 2006.

External Links

External Links

Permanent Citation

Permanent Citation

Andrzej Kozlowski

"A Mean-Reverting Jump Diffusion Process"

http://demonstrations.wolfram.com/AMeanRevertingJumpDiffusionProcess/

Wolfram Demonstrations Project

Published: June 11, 2012