Geske-Johnson Method

Geske-Johnson Method

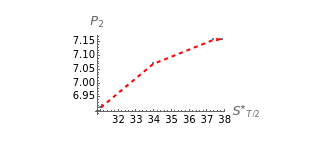

This Demonstration locates the asset critical prices, denoted , that optimize the payoff function of uniformly time-discretized Bermudan puts with one and with two ) possible early exercise temporal points (lower and upper graph, respectively). While European options can be exercised only at the date of expiration, Bermudan options extend the notion of exercise to a finite number of time points during their life. American options, which can be exercised at any time up to maturity, can be approximated by considering Bermudan options, where the number of early exercise points becomes considerably dense; Geske and Johnson[1] apply Richardson extrapolation to accelerate the convergence to an American option.

*

S

()

P

2

(

P

3

Details

Details

Use the controls to select the option parameters and then monitor how the Bermudan put values are reached (this is done with Mathematica's built-in function FindMaximum). The Geske–Johnson analytical formula[1] is applied to estimate the payoff function of the Bermudan puts. The arrows show where their payoff functions are optimized against the corresponding critical asset prices at the time points where early exercise is possible. The goal of the optimization process is to find the corresponding asset critical prices at for Bermudan put and at , for Bermudan put .

T/2

P

2

T/3

2T/3

P

3

Geske and Johnson, in the "G–J" method[1], apply Richardson extrapolation on uniformly time-discretized Bermudan options to approximate the value of an American option, using:

• a European option , which can only be exercised at its maturity

• a Bermudan option, which can be exercised at or

• a Bermudan option, which can be exercised at , , or

P

1

T

• a Bermudan option

P

2

T/2

T

• a Bermudan option

P

3

T/3

2T/3

T

Then, Richardson extrapolation is applied twice to approximate the American put value as , with an error term .

P

P≈=1/2-4+9/2

P

1,2,3

P

1

P

2

P

3

O()

3

h

References

References

[1] R. Geske and H. Johnson, "The American Put Option Valued Analytically," The Journal of Finance, 39(5), 1984 pp. 1511–1524. doi:10.1111/j.1540-6261.1984.tb04921.x.

External Links

External Links

Permanent Citation

Permanent Citation

Michail Bozoudis, Michail Boutsikas

"Geske-Johnson Method"

http://demonstrations.wolfram.com/GeskeJohnsonMethod/

Wolfram Demonstrations Project

Published: November 12, 2014