Portfolio Diversification Benefit from Subadditive VaR

Portfolio Diversification Benefit from Subadditive VaR

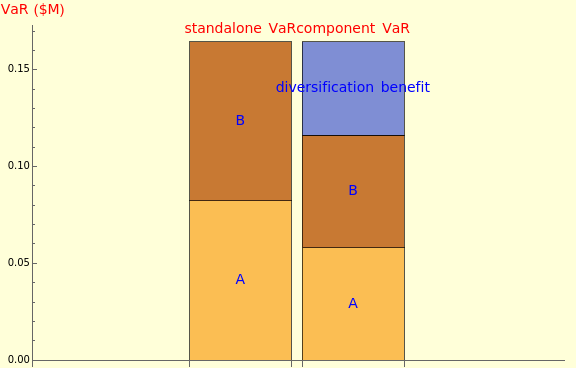

Portfolio diversification benefit derives from investing in various assets whose values do not rise and fall in perfect harmony. Because of this imperfect correlation, the risk of a diversified portfolio is smaller than the weighted average risk of its constituent assets. In term of Value at Risk (VaR), portfolio VaR is smaller than the sum of its constituent VaRs because VaR is a subadditive risk measure: ≤+.

VaR

a+b

VaR

a

VaR

b

On the left, the sum of the standalone VaRs (+) exceeds portfolio VaR () on the right by an amount (the "diversification benefit") that depends on the correlation between the assets.

VaR

a

VaR

b

VaR

a+b

ρ

Consider a simple portfolio worth $1 million, invested in two assets ( and ), with relative weights . The assets have volatilities and are correlated by such that their variance-covariance matrix is .

P

a

b

{,}={,1-}

x

a

x

b

ω

a

ω

a

{,}

σ

a

σ

b

ρ

Σ=

2 σ a | ρ σ a σ b |

ρ σ a σ b | 2 σ b |

Assuming zero asset returns (a reasonable assumption given a short-term investment horizon), the standalone VaR can be calculated: =P, where is the standard normal variate at 100% () confidence level, assuming the asset returns are normally distributed (e.g. =1.645 at 95% confidence level VaR).

VaR

i

z

α

σ

i

x

i

z

a

1-α

z

a

The portfolio VaR is calculated as =·Σ·x.

VaR

a+b

z

α

T

x

Portfolio VaR can be attributed to component assets as component VaRs, which enjoy the additive property and sum to portfolio VaR: =+. In general, component VaR of the asset is defined as =.

VaR

a+b

cVaR

a

cVaR

b

th

cVaR

i

x

i

∂VaR(portfolio)

∂

ω

i

Details

Details

Snapshot 1: when assets are perfectly correlated (), there is no diversification benefit and =+

ρ=1

VaR

a+b

VaR

a

VaR

b

Snapshot 2: when assets are less than perfectly correlated (), there is some diversification benefit and ≤+

ρ<1

VaR

a+b

VaR

a

VaR

b

Snapshot 3: when assets are perfectly contrarian (), the diversification benefit is maximized

ρ=-1

Snapshot 4: when assets are over concentrated (1 or 0), the diversification benefit is reduced

ω

a

ω

a

Snapshot 5: assets that are negatively correlated with other assets in the portfolio can serve as a natural hedge, since they contribute negatively to portfolio VaR (i.e. their component VaRs are negative)

References

References

[1] Kevin Dowd, Measuring Market Risk, 2nd ed., West Sussex, England: Wiley, 2005 pp. 271–274.

External Links

External Links

Permanent Citation

Permanent Citation

Pichet Thiansathaporn

"Portfolio Diversification Benefit from Subadditive VaR"

http://demonstrations.wolfram.com/PortfolioDiversificationBenefitFromSubadditiveVaR/

Wolfram Demonstrations Project

Published: July 3, 2012