Credit Risk

Credit Risk

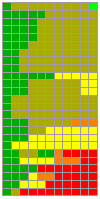

In corporate debt markets, credit risk refers to the risk of loss from bond defaults, as distinct from bond price changes due to fluctuating interest rates, called interest rate risk. Rating agencies provide historical information on the past probability of defaults, as well as year to year changes in bond ratings. Their historical data is used here to construct a Markov chain model of credit risk, showing the changes in ratings through time and loss figures for a random sample of 100 simulated bonds of a given initial credit rating.